Employer Driver Liability: 4 Common Misconceptions

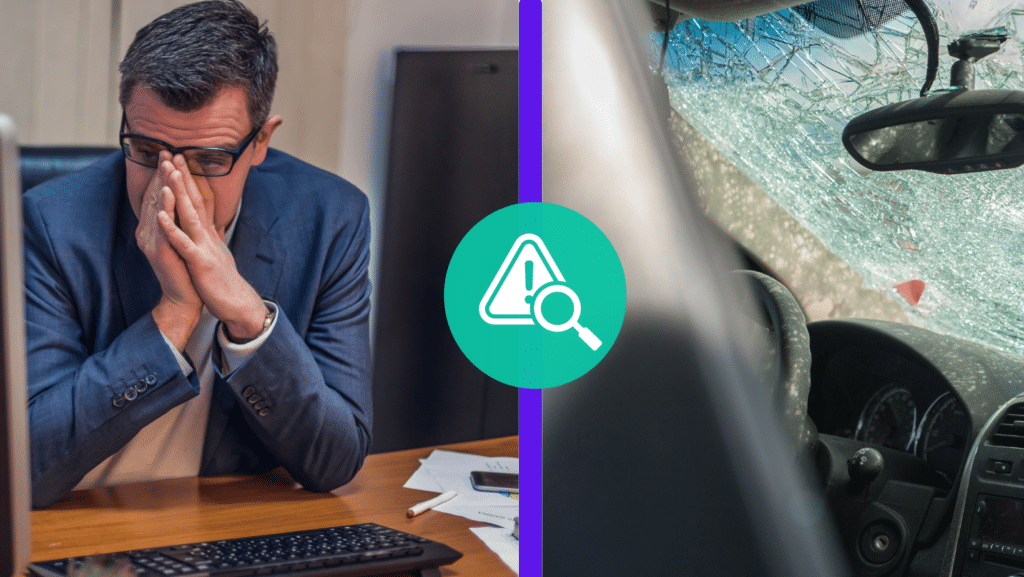

It’s not surprising that companies here in the U.S spend vastly more on lawyers and other legal services than anywhere else in the world. We’re a very litigious society, especially when any hint of employer negligence exists.

Large nuclear verdicts, i.e, really large settlements, are dramatically increasing the cost of medical care and commercial insurance rates across the board. You may feel it when it comes time for your company’s insurance renewals.

Here, we reveal 4 common employer misconceptions that you should avoid to minimize your company’s risk and liabilities.

1. ‘I didn’t know so I can’t be held liable.’

“Not knowing” that one of your employees didn’t possess a valid license at the time of a crash doesn’t mean anything in the courtroom. Employers are responsible for on-the-job performance of all employees who drive for work. Instead of turning a blind eye, make it a habit to check your employee’s driving records consistently.

Oven a dozen active lawsuits remain against the Paramus School District for negligence, medical bills, and emotional distress for a deadly school bus accident in 2018. Read full story here.

2. ‘We don’t have a fleet. Employees drive their own cars, so we’re good.’

It may surprise you to know that employees driving company vehicles represent the same amount of risk as those who drive personal vehicles for business purposes. Employees who run any errands for the business in any vehicle should have valid drivers licenses all the time.

Common examples include:

- Sales Reps who drive to meet clients

- Employees who pick up the occasional office lunch or doughnuts

- Administrative Assistant who picks up mail

- General Manager picking up supplies or deliveries

3. ‘Our current process works just fine.’

As humans, we don’t like change. We like routine and prefer to keep things the way “they’ve always been done.” This is fine until it no longer works. Don’t wait until it’s too much of an administrative burden or risky drivers fall through the cracks to consider a new solution.

Decrease employer driver liability with innovative MVR Monitoring technology that provides real-time alerts regarding license status changes. Not only can it save time and money, but it also reduces the risk of having invalid drivers on the road.

4. ‘ We have a self-reporting policy in place. We’re good.’

Self-reporting policies look good on paper but are barely followed by employees. Studies show 20% to 50% of employers are not notified about drivers’ conviction in a timely matter.

The best way to manage your exposure is being one step ahead of it. A self-reporting policy works best when it is enforced through the proper monitoring and training of employees.

Reduce Your Risk

Vehicle accidents can happen at any time. It is ultimately employers responsibility to look for ways to minimize their own risk. At Embark Safety we help companies simplify driver record management. For questions about our MVR Monitoring software, contact us or schedule a demo.

*We are not lawyers. Consult with your legal counsel to ensure your processes and procedures meet/ or exceed safety standards and compliance regulations. Please read our legal disclaimer.