5 Factors Driving Up Commercial Vehicle Insurance Cost

Are insurance premiums out of control? Understanding the factors that drive up commercial vehicle insurance costs can help you manage premiums more effectively. Here are five key factors and trends affecting auto commercial insurance premiums:

1. Driver History and Record

One of the most significant factors affecting auto commercial insurance premiums is the driving history of your employees. Insurers closely scrutinize driver records to assess risk. Drivers with a history of accidents or claims are considered higher risk, leading to higher commercial insurance premiums.

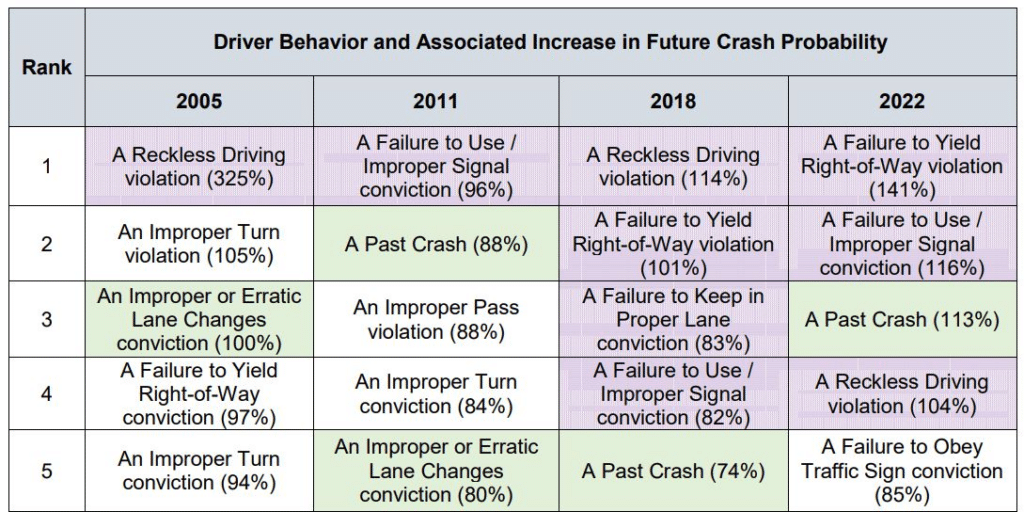

Frequent traffic violations, such as speeding tickets or DUIs, can also drive up costs as they indicate a higher likelihood of future claims. Past behavior is a good indicator of future performance. A study by the American Transportation Research Institute shows the correlation between violations and the likelihood of accidents.

A study by ATRI shows 2022 top 5 violations that increase the likelihood of accidents.

Read more: 4 Traffic Violations Contributing To Fleet Accidents

How to Mitigate:

- Regular MVR Checks: Implement regular Motor Vehicle Record checks to identify risky driving trends. MVR Monitoring technology provides near real-time updates on negative changes in a driver’s record, allowing for early identification and proactive management of your fleet.

- Driver Training Programs: Invest in continuous driver education and safety training to ensure your drivers adhere to safe driving practices and correct frequent infractions. By prioritizing ongoing education, you can significantly reduce the likelihood of accidents and violations, ultimately lowering insurance costs.

2. Distracted Driving

Distracted driving is a growing concern and a significant contributor to road accidents. With the rise of smartphones and other distractions, the risk of drivers being distracted has increased, leading to more accidents and higher commercial fleet insurance rates.

Driving distracted gets compared to drunk driving due to the same psychological pattern. Drivers will drive distracted until they are caught or get in an accident. According to Groth Law Firm, 80% of car accidents are caused by distracted driving.

How to Mitigate:

- Company Vehicle Policies: Implement strict policies against the use of mobile devices while driving.

- Safety Technology: Use telematics and in-cab cameras to monitor driver behavior and reduce distracted driving incidents.

3. Inexperienced drivers

Inexperienced drivers, especially those new to commercial driving, can pose a higher risk on the road. Lack of familiarity with large vehicles, poor handling skills, and insufficient knowledge of safety protocols can lead to increased accident rates, thereby raising commercial vehicle insurance costs.

MVR Monitoring provides comprehensive tools and detailed reports to verify a candidate’s driving history and continuously mitigate risk throughout their employment.

How to Mitigate:

- Thorough Hire Screening Process: Verify the candidate’s past driving experience to ensure they have the necessary skills and experience to handle vehicles. Conduct regular MVR checks and utilize PSP and CDLIS reports for additional crash and road inspection data. Read more: MVRs. vs. PSP vs. CDLIS reports

- Comprehensive Training Programs: Develop and enforce thorough training programs tailored for new drivers, covering all aspects of commercial driving, safety protocols, and vehicle handling.

4. DOT Inspections/Violations

The results of DOT inspections and violations can significantly impact insurance premiums. Poor performance in these inspections can indicate a higher risk of accidents and non-compliance with safety regulations, leading to higher premiums. Additionally, frequent DOT violations contribute to a company’s CSA (Compliance, Safety, Accountability) score, which is used by insurers to assess risk.

How to Mitigate:

- Regular Maintenance and Inspections: Conduct regular maintenance checks and ensure vehicles comply with DOT regulations to avoid violations.

- Driver Qualification Files: Use a Driver File Manager tool to monitor and ensure driver documentation is complete and up-to-date.

5. Recent Nuclear Verdicts and Large Claims

Recent trends in nuclear verdicts and large claims have significantly impacted insurance premiums. Nuclear verdicts (aka large settlements of over $10 million) have increased by 1000% in frequency. Marathon Research found 89 nuclear verdicts against companies in 2023, resulting in jury awards totaling $14.5 billion.

Social inflation, driven by societal trends and more lawsuits, has also pushed up claim costs. Plus, the high cost of vehicle repairs and medical bills has made insurance premiums even higher.

Controlling Commercial Vehicle Insurance Costs

While many factors contribute to rising insurance premiums, there’s still a lot within your control. Insurance companies assess your risk level based on these factors, and they also consider your proactive management and safety practices.

You can positively influence your insurance rates by taking steps to mitigate risks, like MVR Monitoring, driver training, strict policies, and legal preparedness. Proactively managing your fleet and emphasizing safety can lead to more favorable premium rates, helping you manage costs effectively.

Learn more about our Driver Risk Management Solutions. Book a demo

*We are not lawyers. Consult with your legal counsel to ensure your processes and procedures meet/ or exceed safety standards and compliance regulations. Please read our legal disclaimer.